Listen up — Today I’m sharing the true no-strings-attached story of how I harnessed my HELOC to pay off my credit card debt. NOPE, not a scam. Not an ad. Take a deep breath because this is REAL.

If you’ve been following along, you already know how I used a HELOC loan to buy my new house. When I said that strategically harnessing the power of my HELOC was a game-changer, I meant it. So let’s get right into it!

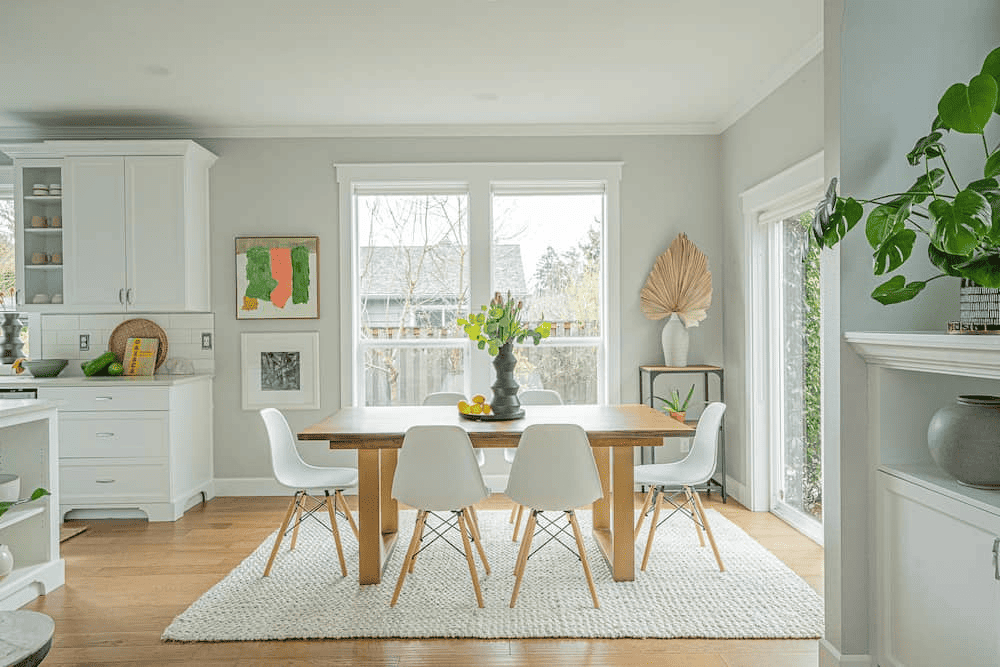

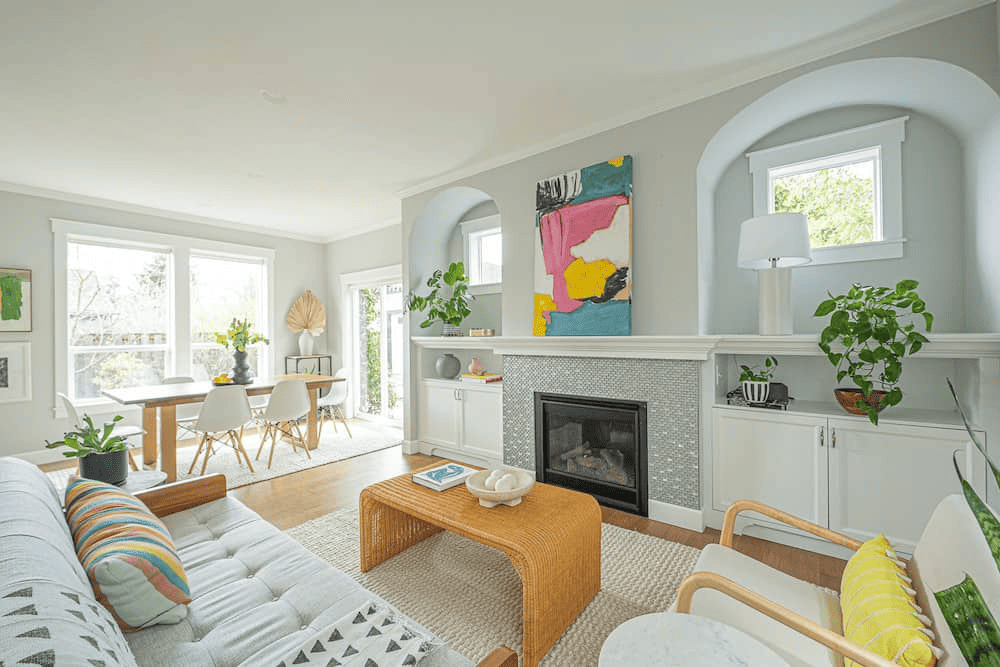

If you’re new here, I’m Lauren Goché — a Portland realtor with a decade of experience backing me up. This means I’ve weathered more than a few market shifts over the course of my career, and specialize in making sure you can make the most of the market for your goals. Read more about me here.

The Epiphany

Alright, it’s time to air out alllll my dirty laundry. A few years back, I found myself drowning in $65k of credit card debt. Yeah, you heard that right. And I could never get ahead because the interest rates were so goddamn high.

I had been talking to Rene Spears, an abundance coach, and she dropped some serious truth bombs on me. She looked me square in the eye and said, “You have equity in your house — use it to pay off your credit cards. It’s the difference between a 5% interest rate with a HELOC while those credit cards are robbing you blind at 25%.”

That was simple math staring me right in the face, and I thought… My god — I have to get on this NOW.

Shedding the Shame: Bless & Release, Baby

Let’s get real for a moment. I had soooo much shame wrapped up in my debt; it was a constant weight on my shoulders that I couldn’t get rid of. But Rene Spears, that brilliant woman, asked me to bless and release that shame. She reminded me of all the amazing things I’d accomplished with that debt— traveling the world, building my business, and helping my friends along the way. It was time to stop the shame short, in its tracks. It was the exact paradigm shift I needed.

The Plan, in Action

After those tears were shed, I went to my lender and pal Lou Xavier (IG: @chronicallyoffbeat) from Trailhead Credit Union and told her I wanted to use the equity in my home. She helped me take a HELOC and I paid off ALL of my credit cards and then I aggressively paid off the HELOC so I owed nothing, zilch — I literally get goosebumps just thinking about it.

Paying off my credit card debt with my home equity was hands down the smartest thing I’ve done and it was what made me go from barely getting along to like really, really getting ahead. I leveraged my assets, and let me tell you, this is the kind of stuff that gets hidden from us who didn’t grow up with that kind of financial knowledge.

The Power of a HELOC Loan

If you want to dive deep into the world of HELOCs, check out my blog here. But for now, let me give you the lowdown:

- A Home Equity Line of Credit is a type of revolving loan that allows homeowners to borrow money against their home equity.

- Home equity is the difference between the value of your home and how much you owe.

- Lenders typically will give you a credit limit of around 80% to 85% of your home equity.

- Generally, HELOCs have a 10-year draw period when you can take money out.

Once you have a HELOC, it can just sit there as a line of credit — you only pay interest on the amount you borrow. Think of it like a credit card, but with a much, much lower interest rate. Even if you don’t have a need for the money, you essentially have a safety net available if you need cash in an emergency or want to upgrade something.

So there you have it folks, this is how I used a HELOC to pay off my credit card debt AND put a down payment on a new home. Whether it’s to use for home improvements, credit consolidation, or as a down payment for your next house, I’m a huge believer that any homeowner with equity should have a HELOC.

Are you looking to buy or sell your home? Get the experienced support you need in Portland’s real estate market by working with me and my experienced team! Let’s get started — get in touch with us here.